Effortlessly craft a comprehensive California LLC Operating Agreement for free, ensuring your business operates smoothly with clear rules and structures.

Lowest cost document generation online and considerably less expensive than hiring a lawyer. No hidden fees.

Written by lawyers & paralegals, our forms create legally binding documents that can be emailed or saved to your device.

We prioritize your privacy & security of sensitive data and use Norton SSL certificate to establish trusted and secure connection.

Rated 4.8 out of 5 based on 14,135 verified reviews on

Answer a few simple questions

to create your document.

Preview how your document looks

and make edits.

Download your document instantly.

Then print or share.

Welcome to our in-depth guide to making an LLC Operating Agreement in California.

This article delves into the essential aspects of LLC law within the Golden State, providing a comprehensive understanding of various critical areas.

California LLC operating agreements serve as a contract among the LLC members (owners), specifying how the business will be run.

It distinctly lays out the agreed terms and responsibilities of the LLC members. Its contents are essential for providing clear instructions on the management and financial arrangements of the LLC.

Although California law does not require a written operating agreement, (Cal. Corp. Code § 17701.02(s)) it helps avoid conflicts by clearly setting out the rights and responsibilities of the members.

A written operating agreement can also avoid applying default legal rules you might not want. If the matter is not addressed in the agreement, the default statutes or laws of the State of California will apply.

It also ensures smooth operation and protects the members’ interests. It provides smooth business processes, including bank account management and profit distribution.

According to the RULLCA, an LLC operating in California can be a single-member LLC or one with multiple members (LLC owners). The law offers flexibility for different scales and types of businesses.

A member of an LLC is not confined to individual persons but can also encompass a separate legal entity or multiple legal business entities. (Cal. Corp. Code § 17701.02(p), (v))

California’s RULLCA rules let LLC members include more than just individuals. This flexibility allows for different business setups and teamwork changes, making it easier for companies to try out various ways of operating.

A person can become a member of a California LLC without necessarily making capital contributions or having an obligation to do so unless the operating agreement specifies otherwise (California Revised Uniform LLC Act (CRULLCA), Cal. Corp. Code § 17704.01(d)). However, it’s important to note that specific responsibilities are attached once a member promises to contribute.

Suppose a member, due to circumstances like death, disability, or any other inability, fails to fulfill their agreed-upon contribution. In that case, they (or their estate) are still obligated to meet these commitments.

In such cases, the LLC may require the member (or the member’s estate) to provide a monetary contribution equivalent to the value of the unfulfilled contribution (Cal. Corp. Code § 17704.03(a)). This provision ensures that the LLC’s financial and operational expectations from its members are maintained, even in unexpected situations.

If the LLC is member-managed, members have voting rights in proportion to their interest in the LLC’s profits unless the articles of organization or a written operating agreement provide otherwise.

A membership interest is what a member owns in an LLC. It includes the following rights:

The following voting acts are prohibited under the RULLCA and cannot be modified by an operating agreement:

Its members govern an LLC unless the articles of organization provide that it will be manager-managed (Cal. Corp. Code §§ 17702.01(b)(5) and 17704.07(a)).

In a member-managed LLC, the members are directly involved in the management and decision-making processes. The power of a member to make decisions is proportionate to their ownership of the LLC. (Cal. Corp. Code § 17704.07(b)).

In a member-managed LLC, the members are directly involved in the management and decision-making processes. The power of a member to make decisions is proportionate to their ownership of the LLC. (Cal. Corp. Code § 17704.07(b)).

The articles of organization or an LLC’s operating agreement can change these standard rules, allowing customization of decision-making to fit the LLC’s unique needs.

Conversely, the managers run the LLC’s activities in a manager-managed LLC. (Cal. Corp. Code § 17704.07(c)) Managers are given exclusive authority over the LLC’s operations decisions in this setup.

Each manager typically has equal powers in conducting business activities. Most decisions are made by most of the managers. But, the operating agreement can change how this works.

In a California LLC, members and managers must stay loyal to the company. This means they should reasonably account for profits, avoid situations where their interests clash with the LLCs, and refrain from competing against the company. These duties strengthen the trust and honesty in the management of the LLC.

In a California LLC, members and managers must follow a duty of care, avoiding gross negligence, intentional wrongdoing, or lawbreaking while managing or closing the LLC’s activities.

This mandate ensures that members and managers conduct themselves responsibly to safeguard the interests of the LLC. (Cal. Corp. Code § 17704.09).

In forming an LLC, it is important to note that there are specific mandatory clauses that an operating agreement cannot alter. ((Revised Uniform Limited Liability Company Act (RULLCA)).

The following provisions must not be changed:

In California, an LLC Operating Agreement can incorporate a variety of optional clauses as long as they do not conflict with the law or the articles of organization. These optional clauses can cover the following:

An LLC name must include the words limited liability company or ‘LLC/L.L.C.,’ with options to abbreviate ‘limited’ and ‘company’ as ‘Ltd.’ and ‘Co.’ respectively.

The name should avoid terms like ‘bank,’ ‘trust,’ or ‘insurance company.’ Per the California Secretary of State’s guidelines, it must be unique and not misleading, ensuring distinguishability from other LLCs and reserved names under RULLCA (Cal. Corp. Code § 17701.08).

Amending the articles of organization requires unanimous member approval unless the articles or a written operating agreement provide otherwise. Still, the operating agreement may not permit approval by less than a majority (Cal. Corp. Code §§ 17704.07(r)(2), (s) and 17701.10(d)(4)).

The fee for filing the certificate of amendment to articles of organization is $30 (Cal. Gov’t Code § 12190(d)).

No filing with the Secretary of State (SOS) is required to amend the operating agreement. The law contains no default provisions regarding filing an amendment to the operating agreement.

Still, to avoid disputes and to keep required records, parties should:

In a California LLC Operating Agreement, solving internal disagreements usually means having a straightforward dispute resolution process. This often starts with steps like mediation or arbitration.

It might also involve special voting rules or agreements on buying and selling shares if conflicts can’t be resolved directly.

These provisions are designed to resolve disagreements efficiently and amicably, minimizing disruption to LLC operations.

A California LLC can be dissolved and its business activities concluded if over half of its members agree to it (or more, if the papers say so) if it goes 90 days without any members (except for businesses with just one owner), or if a court orders it to be dissolved under California law (Cal. Corp. Code § 17707.01 and § 17707.03).

When a California LLC decides to dissolve, it must file a certificate of dissolution with the SOS, except in some instances, such as:

(a) when the LLC opts to file a short-form certificate of cancellation or

(b) when all members vote for dissolution – a decision that must be stated in the certificate of cancellation.

The certificate of dissolution should include the LLC’s name, SOS file number, and the event causing the dissolution.

The certificate may also contain any additional information the members wish to include, although this is typically optional.

Notably, the certificate of dissolution must be filed before or simultaneously with the certificate of cancellation, per the California SOS requirements.

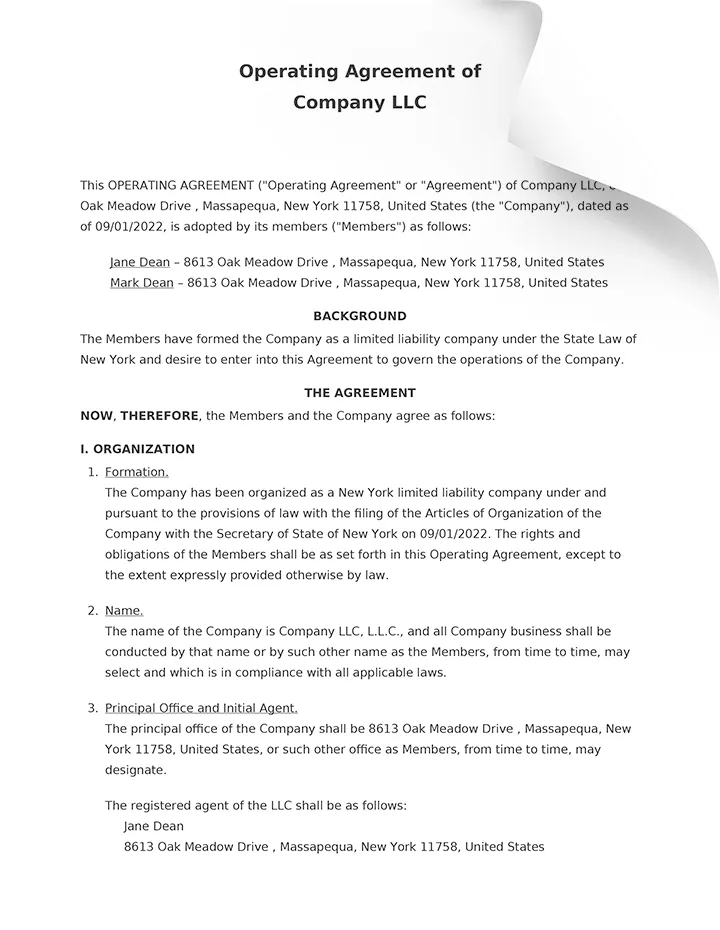

A free LLC Operating Agreement generator can be an invaluable resource for those ready to take the next step in crafting their LLC Operating Agreement.

It simplifies the process, ensuring you cover all essential aspects in compliance with California law.

Click here to easily access the free generator tool to create your customized LLC Operating Agreement or an LLC operating agreement template. It can generate a well-crafted operating agreement developed with the guidance of legal counsel.

Regularly review and update the LLC Operating Agreement to reflect any changes in the business. For example, suppose you decide to expand your services or change how profits are distributed. In that case, these decisions should be documented in the agreement. Maintaining your agreement also involves ensuring that all financial contributions, whether made via check or money order, are recorded accurately.

A: Decisions that can be made under a California LLC Operating Agreement include management structure, allocation of profits and losses, and operational procedures. For example, you may change your business model or introduce new services, which should be outlined in the agreement. Additionally, decisions regarding financial contributions, whether through direct deposit, check, or money order, should be clearly stated in the contract to ensure everything is clear.