Neha is a versatile financial journalist with experience in leading English business news channels. Her wide-ranging reportage includes impactful undercover investigations, multi-billion dollar deal breaks, and incisive coverage of key corporate and policy developments. She's as comfortable anchoring live news on television, as she is writing insightful columns. She focuses on financial markets and global economy, moderates power-packed panels, and interviews influential industry leaders to get you the latest news, views and analysis of the stories that matter. Also, she curates, hosts and produces Pathbreakers and Money Talks. She holds a postgraduate degree and specialisation certificates in the area of finance from global institutes. When she's not fussing over inflation or balance sheets you may find her on a yoga mat in some beautiful part of the world. But she's always up for good coffee and interesting ideas.

(From left) Ankit Fatehpuria, co-founder, Vishal Chaudhary, co-founder, Amrit Acharya, co-founder & CEO, Srinath Ramakkrushnan, co-founder & COO, Rahul Sharma, co-founder, Zetwerk Image: Selvaprakash Lakshmanan for Forbes India

I n 2018, four IIT graduates got together to build a marketplace for custom manufacturing to connect SMEs with mid-large original equipment manufacturers (OEMs) operating across a range of industrial sectors. Soon, the manufacturing services platform expanded its footprint to the US, Mexico, and the Middle East. About three years after it received seed funding of $1.5 million from Kae Capital and Sequoia Capital in August 2018, the company hit the $1 billion valuation mark to become the 25th unicorn of 2021.

This is the meteoric rise of Zetwerk and its five founders Amrit Acharya, Srinath Ramakkrushnan, Rahul Sharma, Vishal Chaudhary and Ankit Fatehpuria, a story that started with a shared interest for solving some of the imbalances in the largely unorganised manufacturing ecosystem.

Acharya, co-founder and CEO, had enjoyed the experience of handling supply chains at ITC for four years, and his friend Ramakkrushnan, co-founder and COO, had a small family-owned manufacturing unit and was familiar with the ins and outs of the industry. “We basically explored what we had done before. It came together organically even though it was an unusual venture,” says Acharya.

The founders started out from a one-bedroom apartment in Bengaluru. Zetwerk was initially conceptualised as a SaaS platform, but within months switched to become a manufacturing marketplace to leverage opportunities better. This move helped the company tap into niche openings arising from the disruption of global supply chains due to the pandemic and the rising hostility between China and the US. In a way, again, there is an underlying shift as the company seems to be transitioning from a “manufacturing services platform” to a “global manufacturer”.

Zetwerk declined to share order book, global and domestic supply chain partners, customers, and specific financial details requested. Its website lists six partners and customers including Bhel, Tata Steel, and Sterling & Wilson, but it claims to have over 1,800 active customers in more than 20 countries. It says it has manufactured over nine million parts for a wide range of industries comprising transportation, industrial machinery and equipment, consumer products, electronics, apparel and textiles, construction and infrastructure, energy and utilities, aerospace and defence. In April 2022, it won the contract to supply fabricated girders for the bullet train project.

The company’s steepest growth curve came about around the pandemic as the company quickly regrouped to address gaps in supply linkages for manufacture of industrial and consumer goods. “So, while initially it was a little bit challenging, I think the business definitely became sharper and better. We have almost done 15 to 20 times more business. I think it was because we were at the right place at the right time and also because the business model was extremely efficient and streamlined at all times,” reflects Acharya on how they turned a crisis into an opportunity.

In the aftermath of lockdowns, from a “significant” loss of revenue for several months, Acharya claims Zetwerk diversified into new business categories like apparel, consumer electronics and smartwatches, to minimise risks and volatility. Previously, industrials formed the bulk of its business, contributing nearly 70 percent to total revenue, but the company made inroads into the consumer segment, among others, for manufacturing contracts. In a span of two years, its international market grew to 15 percent from zero earlier, according to Acharya. The lack of physical due diligence in foreign manufacturing facilities notwithstanding, the company says it was able to ink new pacts over Zoom calls and has partners in countries like the US, Mexico and Vietnam.

“We were helping deal with a digital selection of suppliers, we helped with digital remote monitoring of all the projects that customers had given us. It was earlier perceived as a good-to-have but suddenly there was no other way of doing business,” Acharya says.

Also read: Isha Ambani: Her father's daughter

Acharya says Zetwerk is creating a transparent operating system of the industry to align the incentives of stakeholders through software, and enable customers, suppliers, and various stakeholders to participate.

“For customers, it is a Zetwerk seal of assurance on quality, price, and timely delivery. Customers like us because they find us reliable. When they give an order to us, it gets delivered on time with no issues with quality and there’s a very strong customer service in terms of providing transparent updates similar to how you order stuff on ecommerce platforms like Amazon,” he adds.

There are thousands of SMEs in the manufacturing sector in India operating at about 40 to 50 percent capacity. Zetwerk aims to help provide additional revenue to these SMEs by connecting them with vendors and suppliers for specific equipment, industrial components, and customised products. This helps them push capacity utilisation levels from, say, 40 to 60 percent. Also, Zetwerk seeks to partner with these entrepreneurs by providing end-to-end manufacturing solutions.

Other players in this space include OfBusiness, a B2B platform for purchasing raw material and availing small ticket loans for SMEs. Infra.Market, also operates as an online marketplace for order of construction material. Moglix, a close peer, seeks to address procurement needs, manufacturing contracts, financing, and supply chain management. So, what differentiates Zetwerk?

“Any small manufacturer who works as an associate makes more revenue after working with us than they were before. We help them with the logistics, revenue, and everything else and let them focus on the core part of the business. So, our suppliers become strong partners. The additional revenue we give them, a small part of that becomes our revenue,” says Acharya.

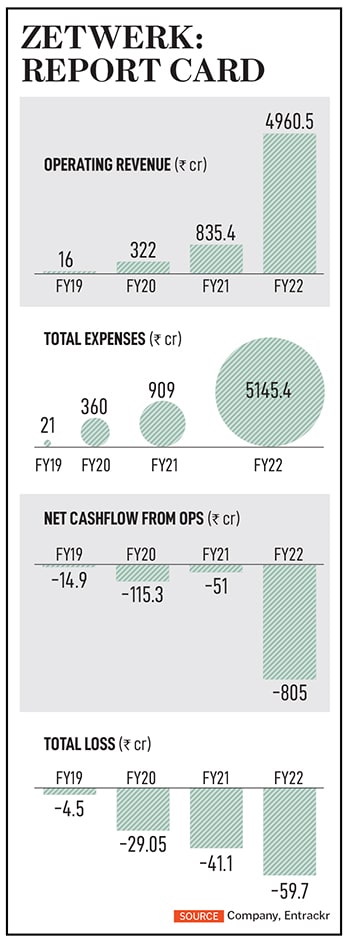

The company reported an operating revenue of ₹16 crore in FY19 which soared to ₹4,960.5 crore in FY22. During the same period, total expenses rose from ₹21 crore to ₹5,145.4 crore. While the company is relatively close to its break-even point, the net loss increased from ₹4.5 crore to ₹59.7 crore during the mentioned period.

Acharya wants to drive the Make in India story. He notes India is benefitting from orders flowing in from global markets, and its underlying robust domestic demand. “When we see the larger horizon, we realise that India is going to be a manufacturing superpower and we see a lot of potential in the market currently, and we see ourselves playing a small role in the larger picture,” he adds.

In May last year, Zetwerk set up a manufacturing facility in Noida for wearables and hearables, and has been on an acquisition spree since then. It bought four companies at a total cost of over ₹400 crore to add heft to its manufacturing proposition: Pinaka Aerospace, Sharp Tank, The Wardha, and US-based Unimacts.

This has confounded some bankers as they are concerned about the company’s growth strategy. “We haven’t quite understood their business model or how they will make money so we stayed away from it,” says an investment banker working at a leading firm, on condition of anonymity.

An M&A expert who did not want to be identified says the company is scouting for new buyouts in the US, but he is worried if Zetwerk’s growth trajectory is sustainable.

“Execution is a ridiculously big challenge as it involves a high degree of quality control, working capital, and reliability. This is why they are now getting into acquisition of manufacturing facilities,” says the M&A expert mentioned earlier.

Acharya says that electronics, renewables, and the US business are the primary areas of focus currently. Zetwerk is also looking to enter categories like specialty chemicals and EVs and expects high-capital intensive growth to continue. “When we talk about growth we always talk about profitability and the internal capital. We are looking to grow more in this year but currently we do not have any visibility on fund raising,” he adds.

Zetwerk raised approximately $240 million in its latest fundraising round in December 2021 at a valuation of $2.7 billion versus a valuation of $245 million in July 2020 and $1.3 billion in August 2021. Its key investors include DI Capital, Sequoia Capital, Accel Partners, Greenoaks Capital, Lightspeed Partners, Steadview, and Kae Capital. In March, it raised Rs 100 crore debt in a financing round led by Edelweiss Group.

Zetwerk has hit the bullseye when it comes to identifying gaps in the manufacturing chain. It is also looking to tap into the rising global chaos as countries try to secure supply chains by adopting a China-plus-one strategy in light of geopolitical concerns. But its business model is clearly a work-in-progress as it finetunes its strategy and positioning.

It’s got off to a good start, but it’s a long, winding road ahead, and execution is the litmus test of how sustainable it will be once growth capital stabilises. As has been the case with several promising unicorns, the challenge is to focus on profitability rather than reckless diversification for expansion and revenue growth.

(This story appears in the 31 March, 2023 issue of Forbes India. To visit our Archives, click here.)